Trump doubles tariffs on India, straining bilateral relations. The relationship between the United States and India, two of the world’s largest democracies, has entered a turbulent phase. On August 27, 2025, U.S. President Donald Trump officially doubled tariffs on imports from India, raising duties to as much as 50%. This move, framed as punishment for New Delhi’s continued purchase of Russian oil, is already straining bilateral ties that had been steadily growing over the past two decades.

The decision is more than just a trade dispute—it has deep political, economic, and diplomatic implications. For India, one of the fastest-growing major economies, the impact could be severe. For Washington, it represents an aggressive approach to pressuring a key partner in Asia at a time when global alliances are shifting rapidly.

Read More: https://www.moneynewsweb.com/business-community-concerned/

What the New Tariffs Mean

Trump’s action adds an additional 25% punitive duty on top of an existing 25% tariff previously placed on many Indian goods. The combined duties now reach 50%, one of the highest rates imposed by the U.S. on any trading partner.

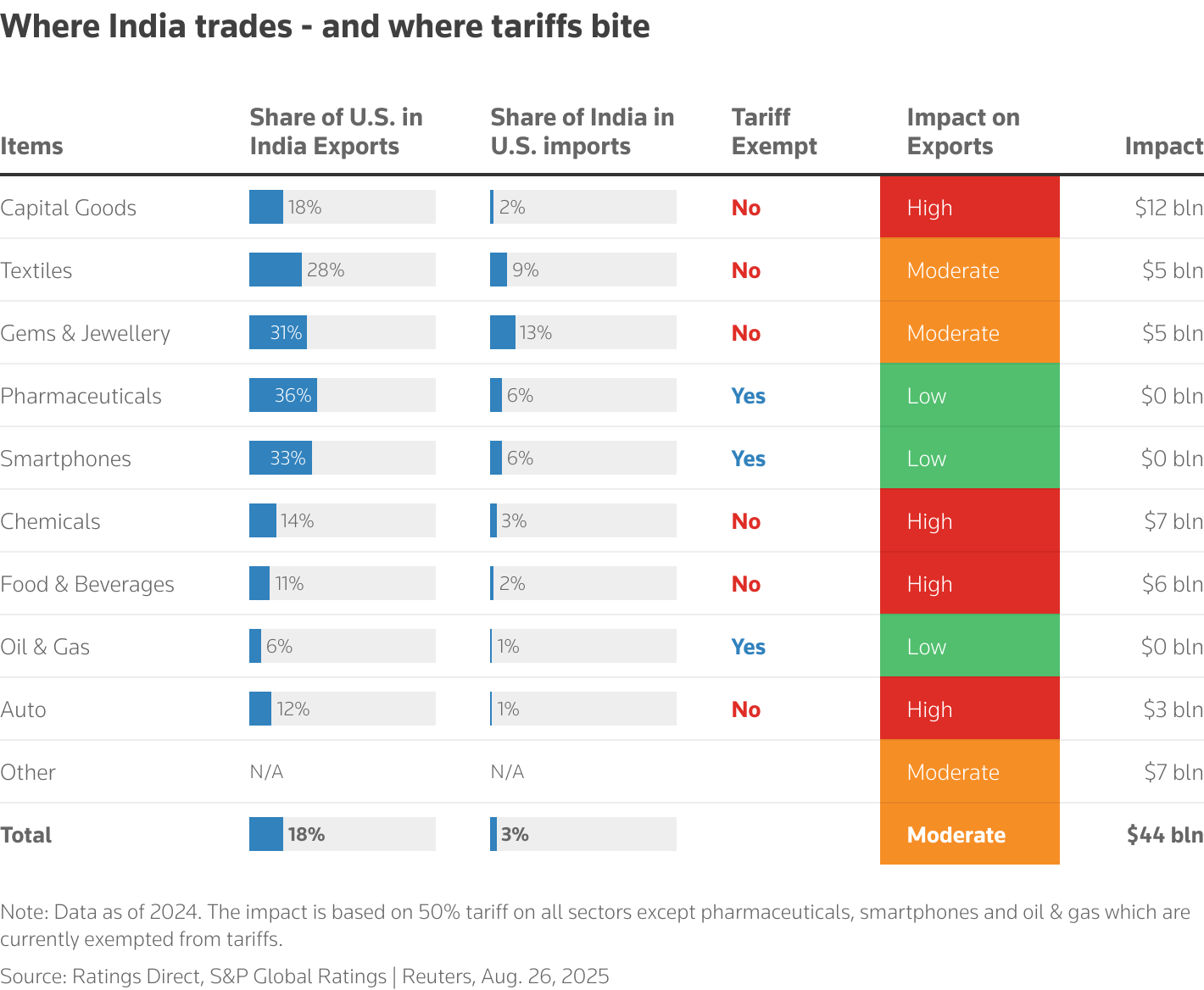

Products hit hardest include garments, gems and jewelry, footwear, sporting goods, furniture, and chemicals. These industries support thousands of small businesses and workers across India, particularly in Prime Minister Narendra Modi’s home state of Gujarat.

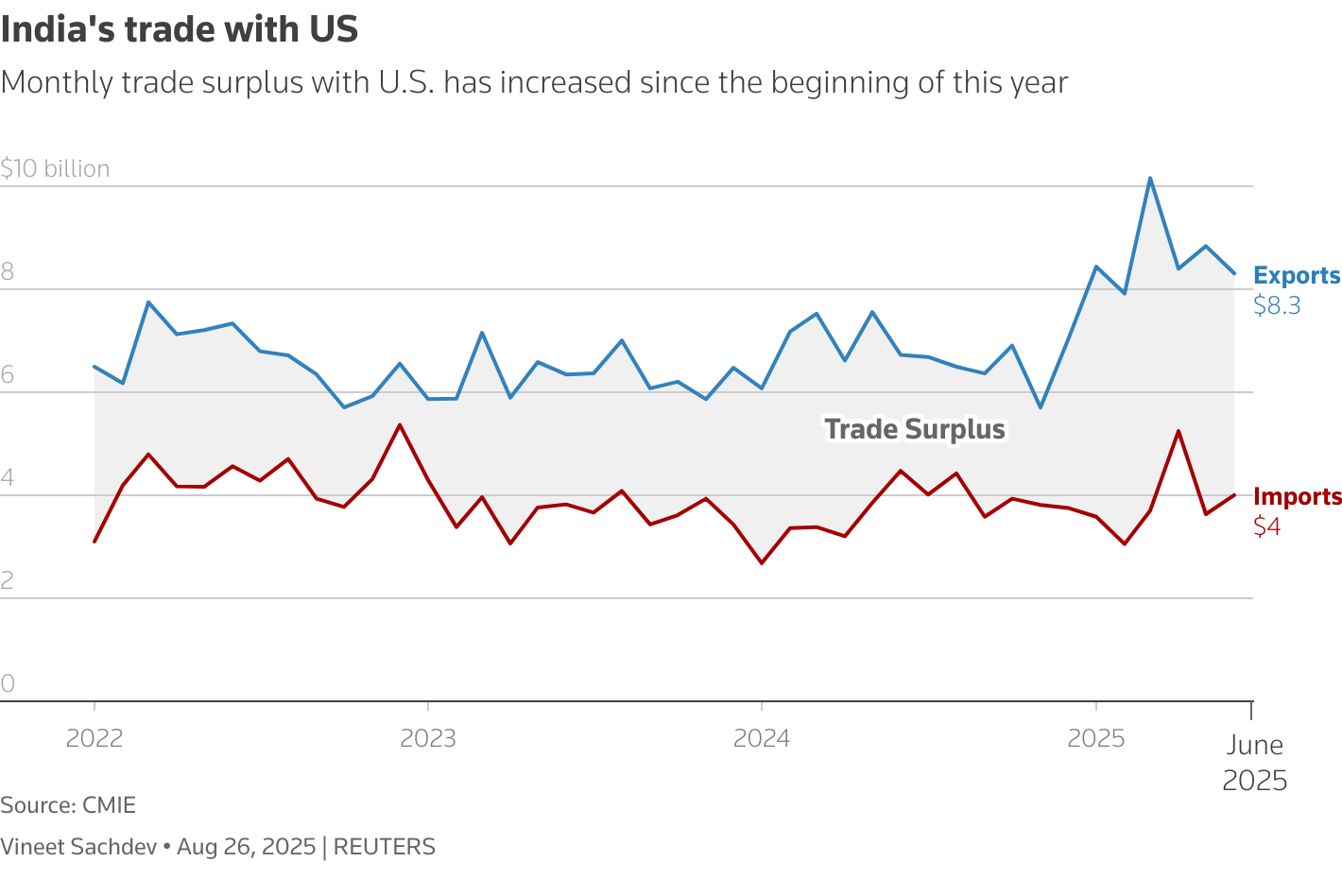

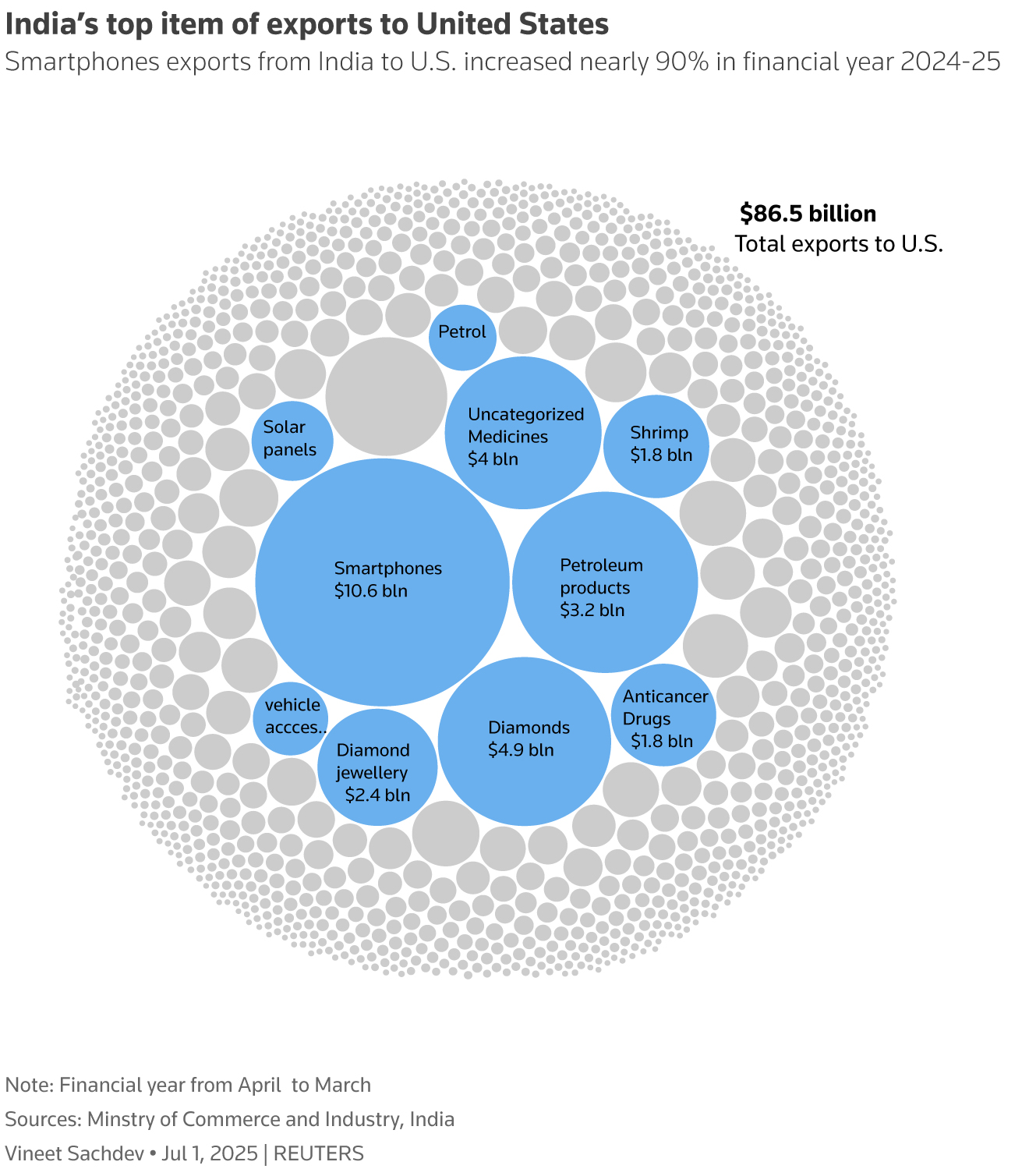

With India exporting $87 billion worth of goods to the U.S. in 2024, economists warn that nearly 55% of exports could be affected. This puts millions of Indian jobs at risk, while also reducing India’s competitiveness in the global market.

Why Washington Took This Step

According to White House trade adviser Peter Navarro, the logic is simple: stop buying Russian oil, and the tariffs go away.

“It’s real easy. India can get 25% off tomorrow if it stops buying Russian oil and helping to feed Russia’s war machine,” Navarro told Bloomberg Television.

The U.S. argues that New Delhi’s oil trade with Moscow indirectly funds Russia’s war in Ukraine. India, however, rejects this accusation as unfair and hypocritical. Indian officials point out that both the U.S. and European nations continue significant business dealings with Russia in other sectors.

Despite being one of Russia’s top oil buyers, China has not faced similar punitive tariffs, largely because Trump is seeking to maintain a fragile trade truce with Beijing. For many in New Delhi, this highlights a double standard in Washington’s approach.

Failed Trade Talks

The tariffs also reflect the collapse of five rounds of U.S.-India trade negotiations, which aimed to reduce Washington’s duties on Indian goods. The goal was to lower tariffs closer to 15%, similar to agreements the U.S. has struck with Japan, South Korea, and the European Union.

Instead, talks broke down amid what officials described as “miscalculations and missed signals.” The lack of progress leaves no immediate prospect of relief, and both sides appear entrenched in their positions.

Market Reactions in India

The tariff announcement rattled India’s financial markets. On Tuesday, a day before the tariffs took effect, Indian stock benchmarks recorded their worst session in three months. The rupee also fell to its lowest level in three weeks, continuing a five-day losing streak.

Although markets were closed on the day of implementation due to a Hindu festival, analysts warn that the effects will deepen in the weeks ahead. Exporters, especially in textiles and jewelry, now face a sudden loss of competitiveness against rivals in Vietnam, Bangladesh, and China.

Economic Risks and Opportunities

The tariffs will clearly hurt Indian exporters, but analysts caution against seeing the situation as entirely negative. Some experts believe the crisis could push India to accelerate long-needed reforms.

Economist Rajeswari Sengupta of the Indira Gandhi Institute of Development Research suggests that allowing the rupee to depreciate could provide indirect support to exporters by making Indian goods cheaper abroad. She also calls for a more trade-oriented, less protectionist strategy to stimulate demand and attract global investment.

Still, the short-term risks are significant. According to Sujan Hajra, chief economist at Anand Rathi Group, up to two million jobs could be threatened. However, he notes that India’s strong domestic demand, diversified export base, and stable inflation outlook may cushion some of the blow.

Broader Diplomatic Consequences

The tariff standoff comes at a delicate moment for U.S.-India relations. The two countries are not only economic partners but also strategic allies with shared concerns about China’s growing influence in Asia.

Despite the current rift, officials from both nations recently met virtually to reaffirm their commitment to strengthening ties. A joint statement from senior defense and foreign ministry officials expressed “eagerness to continue enhancing the breadth and depth of the bilateral relationship.”

Still, the optics are worrying. By targeting India with tariffs comparable to those levied on China and Brazil, Washington risks alienating a country that has often been viewed as a counterbalance to Beijing.

India’s Response

India has so far adopted a cautious tone. Junior foreign minister Kirti Vardhan Singh told reporters that the government is taking steps to minimize economic damage.

“Our concern is our energy security, and we will continue to purchase energy sources from whichever country benefits us,” Singh emphasized.

Behind the scenes, officials hope the U.S. will eventually reconsider the extra 25% levy. At the same time, New Delhi is exploring measures to support affected industries and workers.

Who Benefits from the Tariffs?

While Indian exporters suffer, competitors across Asia may benefit. Countries like Vietnam and Bangladesh, which already have growing textile and manufacturing sectors, could capture U.S. market share lost by India.

China, despite being Washington’s primary rival, might also gain indirectly, as some supply chains shift away from India. This could undermine Washington’s broader goal of reducing dependence on Chinese manufacturing.

Frequently Asked Questions:

What did President Trump announce about tariffs on India?

President Trump doubled tariffs on Indian imports, raising duties to as much as 50%. The new measure includes a 25% punitive tariff on top of existing 25% tariffs, targeting goods such as textiles, gems, jewelry, footwear, chemicals, and furniture.

Why did the U.S. impose higher tariffs on India?

The U.S. increased tariffs in response to India’s continued purchases of Russian oil, which Washington says indirectly funds Moscow’s war in Ukraine. The move is meant to pressure New Delhi into cutting energy ties with Russia.

How will these tariffs affect India’s economy?

The tariffs threaten millions of jobs in export-driven industries and could harm India’s economic growth. Sectors like textiles, jewelry, and footwear are especially vulnerable, as they rely heavily on U.S. demand.

How much trade happens between the U.S. and India?

In 2024, U.S.-India two-way goods trade totaled $129 billion, with India exporting $87 billion to the U.S. The U.S. trade deficit with India stood at $45.8 billion.

Which Indian sectors are hit the hardest?

Garments, gems and jewelry, footwear, furniture, sporting goods, and chemical exports face the steepest tariffs. Exporters in these industries are likely to lose competitiveness against rivals in Vietnam, Bangladesh, and China.

How did India react to Trump’s tariff decision?

India’s government called the move unfair but emphasized that energy security remains its priority. Officials stated India will continue buying oil from sources that benefit its economy, including Russia.

Did U.S.-India trade talks fail?

Yes. After five rounds of negotiations, Washington and New Delhi failed to reach a deal to lower tariffs. Talks collapsed due to miscalculations and missed signals, leaving the tariff dispute unresolved.

Conclusion

Trump’s decision to double tariffs on Indian imports marks a critical turning point in U.S.-India relations. While the move aims to pressure New Delhi over Russian oil purchases, it risks undermining decades of progress in building a strategic partnership between the two democracies. For India, the challenge lies in protecting jobs, supporting exporters, and accelerating reforms to stay competitive in global markets. For Washington, the danger is alienating a vital ally in Asia at a time of rising geopolitical tensions with China. Whether this dispute becomes a temporary setback or escalates into a prolonged standoff will depend on the willingness of both sides to return to the negotiating table.