The Financial Planning Software market is experiencing rapid growth as individuals and organizations seek advanced tools to manage increasingly complex financial operations. This software delivers comprehensive solutions for budgeting, forecasting, and strategic financial planning, catering to consumers, financial advisors, and enterprises alike. Adoption of cloud-based technologies and a focus on digital transformation in financial services are further accelerating market expansion. By providing real-time data analysis, these tools enable users to make informed financial decisions, streamline operations, and enhance overall financial efficiency.

Read More: https://www.moneynewsweb.com/oracle-unleashes-groundbreaking-ai/

Key Growth Drivers

Several factors are fueling the growth of the Financial Planning Software market. Rising demand for automated solutions has empowered businesses and individuals to improve financial decision-making and reduce manual workloads. Growing financial awareness among consumers has also increased the need for software that offers predictive analytics, scenario planning, and detailed forecasting capabilities. Regulatory compliance requirements further reinforce the adoption of these tools, as companies rely on financial software to meet legal obligations efficiently. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) has enhanced software capabilities, making predictions more accurate and planning more intuitive.

Market Opportunities

The market holds significant opportunities, particularly in developing economies where digital financial management practices are still gaining traction. As businesses and individuals recognize the advantages of organized financial planning, demand for robust software solutions is expected to surge. The development of user-friendly platforms for non-expert users is another growth avenue, broadening the market base. Additionally, the increasing trend toward mobile-based solutions offers potential for growth, as mobile financial planning apps provide accessibility, convenience, and real-time financial insights.

Market Statistics and Insights

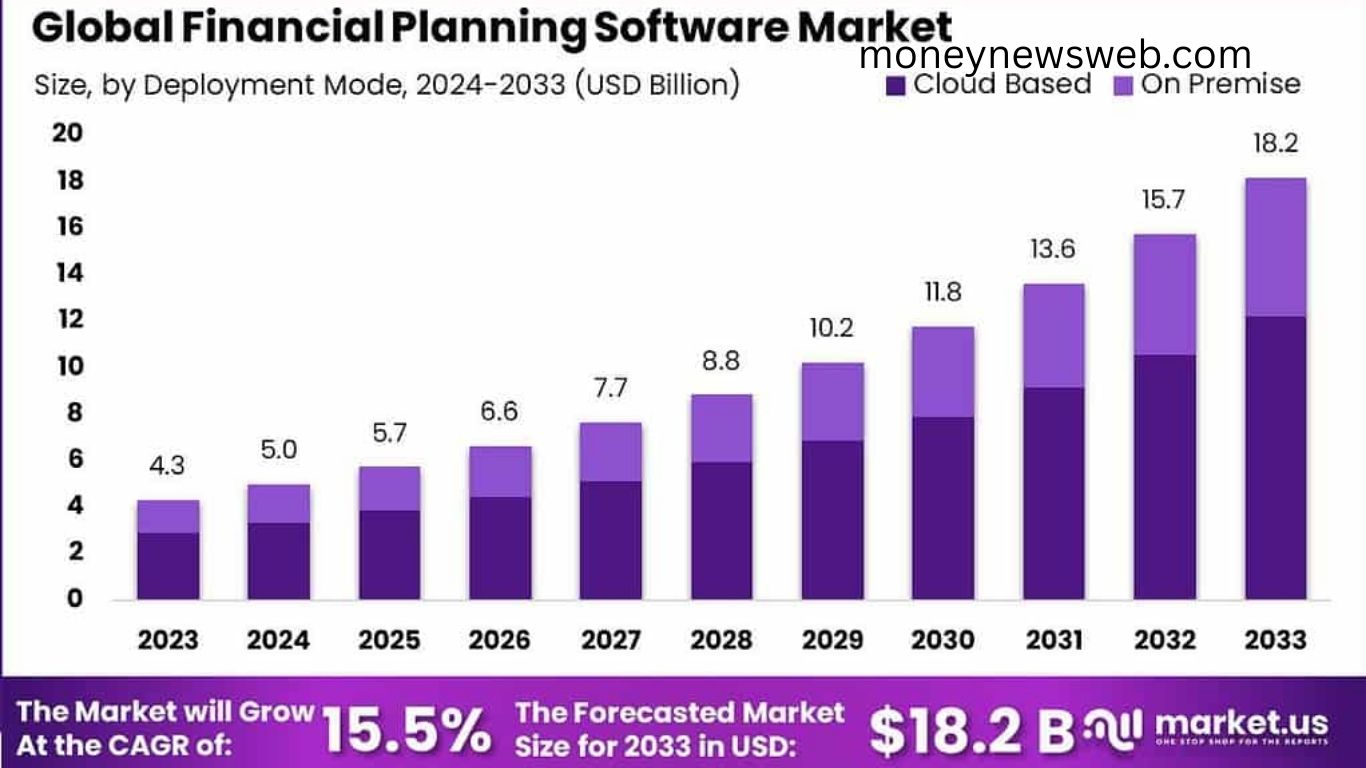

Global Market Valuation: USD 4.3 billion in 2023, projected to reach USD 18.1 billion by 2033, at a CAGR of 15.5%.

- Deployment Mode Insights: Cloud-based solutions dominate with a 67.1% market share in 2023 due to scalability, lower operational costs, and seamless integration.

- Application Insights: Investment planning leads application categories with a 28.4% share, reflecting its importance in optimizing asset management and investment strategies.

- End-User Insights: Enterprises hold a dominant 78% market share, demonstrating widespread adoption among large organizations.

- Regional Insights: North America commands a 37.5% share, driven by advanced technological infrastructure and early adoption of innovative financial solutions.

Growing Influence of AI in Financial Services

The integration of AI in financial services is reshaping the market landscape. The Generative AI in Financial Services Market is projected to grow from USD 847.5 million in 2023 to USD 10.4 billion by 2033, at a CAGR of 28.2%. AI enhances forecasting accuracy, automates repetitive tasks, and supports scenario-based financial planning. By 2024, 70% of new FP&A initiatives will incorporate AI and ML, further improving decision-making efficiency. Over 80% of businesses now integrate business intelligence (BI) tools with FP&A systems to enhance accuracy and accelerate financial analysis.

Leading Financial Planning and Analysis Software

- Anaplan – Offers real-time modeling, scenario planning, and predictive analytics across finance, HR, and sales. Ideal for large enterprises.

- NetSuite Planning and Budgeting – Focuses on budgeting, forecasting, and consolidations; integrates seamlessly with other NetSuite ERP tools.

- OneStream – Unified platform for budgeting, forecasting, and consolidation; handles large volumes of data for enterprises.

- Oracle Cloud EPM Planning – Scalable solution with extensive predictive analytics and scenario modeling.

- Prophix – User-friendly, ideal for mid-sized companies; automates reporting and planning with minimal technical overhead.

- SAP Analytics Cloud – Strong in predictive analytics and visualization; integrates with SAP ERP systems.

- Vena Complete Planning – Excel-based interface for collaborative planning; highly customizable for mid-sized businesses.

- Workday Adaptive Planning – Predictive analytics and planning tools; integrates seamlessly with Workday HR and financial products.

Deployment and Application Insights

Cloud-Based Solutions dominate the market due to flexibility, cost efficiency, and scalability. Users can access software remotely, collaborate in real time, and scale resources without heavy infrastructure investment. On-Premise Solutions remain relevant for enterprises with stringent security and data privacy requirements, despite higher initial investments.

Within applications, investment planning remains the most significant segment, driven by the need for detailed forecasting, risk analysis, and scenario planning. Large organizations leverage these tools to optimize asset allocation and manage complex investment portfolios.

End-User Adoption

Enterprises account for the largest adoption, with 78% market share in 2023. Large corporations utilize these solutions to streamline budgeting, reporting, and financial forecasting. Cloud-based platforms enable real-time data sharing across departments, improving efficiency, reducing costs, and enhancing risk management. Digital transformation initiatives further encourage adoption, as organizations seek accuracy and operational efficiency in financial planning.

Emerging Trends

- Complexity and Diversification – Financial planning tools now support advanced services like tax optimization, estate planning, and retirement strategies.

- AI and Automation Integration – Real-time scenario analysis, predictive forecasting, and data-driven decisions are transforming financial planning.

- Integrated Business Planning – Platforms are increasingly combining multiple financial functions to improve operational cohesion.

- Tailored Client Solutions – AI-driven personalization enhances customer engagement by offering customized recommendations.

- Efficiency and Cost Management – Businesses are leveraging software to optimize processes and reduce operational expenses.

Key Use Cases

- Comprehensive Client Management – Holistic view of investments, savings, insurance, and retirement portfolios.

- Risk Management and Compliance – Automated monitoring of compliance and advanced risk analysis.

- Scenario Planning and Forecasting – Preparation for various market conditions to enhance strategic decision-making.

- Automated Workflow Processes – AI-driven automation reduces manual labor, increases accuracy, and accelerates reporting.

- Integrated Business Planning (IBP) – Synchronizes financial data across departments to support better decision-making.

Challenges in the Market

- Increasing Complexity – Meeting evolving client needs such as estate planning and tax optimization.

- Technology Limitations – Software sometimes cannot fully support expanding financial services, necessitating manual processes.

- Adaptation to Market Changes – Economic fluctuations and policy changes require agile financial planning.

- Consumer Behavior Uncertainty – Volatile markets complicate accurate long-term planning.

- System Integration – Compatibility with existing business systems remains a hurdle for many organizations.

Opportunities for Growth

- Tech Stack Diversification – Combining specialized tools with core planning software to address unique client needs.

- AI-Driven Personalization – Delivering tailored financial advice based on individual client goals and data.

- Advanced Analytics – Leveraging predictive analytics and scenario modeling to navigate market uncertainties.

- Expansion into Emerging Markets – High-growth regions like Asia-Pacific present opportunities for adoption and localized solutions.

- Regulatory Compliance and Security – Providing secure platforms that meet evolving regulatory standards.

Frequently Asked Questions:

What is the projected size of the Financial Planning Software Market by 2033?

The market is expected to grow from USD 4.3 billion in 2023 to approximately USD 18.2 billion by 2033, reflecting a compound annual growth rate (CAGR) of 15.5% during the forecast period.

Which region dominates the Financial Planning Software Market?

North America held a significant share of the global market, driven by advanced technological infrastructure and early adoption of innovative financial planning solutions across industries.

How is technology influencing the Financial Planning Software Market?

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is enhancing predictive analytics, improving forecasting accuracy, and streamlining financial planning processes.

How do financial planning software solutions address security and compliance?

Leading software solutions incorporate robust security measures and ensure compliance with financial regulations, providing users with secure and reliable tools for financial management.

What opportunities exist in the Financial Planning Software Market?

Opportunities include expanding into emerging markets, developing user-friendly platforms for non-expert users, and offering mobile-based solutions to cater to the growing demand for accessible financial planning tools.

What is the CAGR of the Financial Planning Software Market?

The market is projected to grow at a compound annual growth rate (CAGR) of 15.5% between 2023 and 2033, reflecting strong global demand for automated financial planning solutions.

Which deployment mode dominates the market?

Cloud-based solutions dominate, accounting for over 67% of market share in 2023 due to flexibility, remote accessibility, lower costs, and ease of integration.

Conclusion

The Financial Planning Software market is on a dynamic growth trajectory, poised to reach USD 18.2 billion by 2033, driven by increasing financial complexity, digital transformation, and the adoption of AI-powered solutions. Cloud-based platforms, investment planning tools, and enterprise-focused solutions are leading the market, enabling organizations and individuals to streamline financial management, enhance forecasting accuracy, and ensure regulatory compliance. Emerging trends such as personalized financial planning, mobile accessibility, and integrated business planning are expanding the market’s reach, while opportunities in emerging economies and AI-driven analytics offer further growth potential. Despite challenges like technological limitations and evolving consumer behavior, the market remains robust, presenting significant opportunities for software providers, financial advisors, and enterprises seeking smarter, more efficient financial planning solutions.